nothing at all. If targets are exceeded, the Organization & Compensation Committee has discretion to adjust payments to the executives. The Organization & Compensation Committee has discretion to increase, reduce or eliminate payments.

Incentive Program (the

“2010“2012 LTIP”) for executive officers and other eligible employees of the Company. The

20102012 LTIP has a

two32 month performance period for performance-based grants and a three year

performance period.vesting period for service-based grants. The Company uses long-term incentive compensation for executives to reinforce four strategic objectives:

to focus on the importance of returns to shareholders;

to promote the achievement of long-term performance goals;

| | |

| • | to focus on the importance of returns to shareholders; |

|

| • | to promote the achievement of long-term performance goals; |

|

| • | to encourage executive retention; and |

|

| • | to promote higher levels of Company stock ownership by executives. |

to encourage executive retention; and

to promote higher levels of Company stock ownership by executives for increased alignment with shareholder interests.

Historically, the Company has strived to set a sizeable portion of the Named Executive Officer’s compensation in an equity-based form. This type of compensation, coupled with the Company’s share ownership guidelines, will result in the executives becoming shareholders with considerable personal financial interest in the fiscal health and performance of the Company.

The amount of equity-based awards granted to executives has been determined by subtracting the executive’s annual cash compensation opportunity from the total targeted annual compensation that is competitive with the market (generally in the 50th percentile range) based on SEC filings for our peer group and broad based industry studies. The ultimate value of these equity-based awards has been driven in part by the executive’s performance in the past fiscal year and in part by their ability to increase the value of the Company going forward.

Our equity-based compensation in fiscal year 20102012 included awards of restricted stock and stock options and are described as follows:

Restricted stock — A grant of restricted stock is an award of shares of Common Stock that vests over a period of time after the grant date (depending upon the vesting conditions set by the Organization & Compensation Committee), provided that underlying goals are met in the case of performance-based grants or that the participant remains employed with the Company for the specified amount of time in the case of non-performance, time-based grants. Restricted stock awards are designed to attract and

35

| | |

| | • | Restricted stock — A grant of restricted stock is an award of shares of Common Stock that typically vests over a two- to five-year period after the grant date (depending upon the vesting conditions set by the Organization & Compensation Committee), provided that underlying goals are met in the case of performance-based grants or that the participant remains employed with the Company for the specified amount of time in the case of non-performance, time-based grants. Restricted stock awards are designed to attract and retain executives by providing them with some of the benefits associated with stock ownership during the restriction period, while incentivizing them to remain with the Company. During the restricted period, the executives may not sell, transfer, pledge, assign or otherwise convey their restricted stock. However, executives may vote their shares and are entitled to receive dividend payments, if any are made. Executives who voluntarily resign or are terminated for cause prior to the end of the restriction period forfeit their restricted stock unless otherwise determined by the Organization & Compensation Committee. |

|

| • | Stock options — A grant of stock option awards represents the right to purchase the Company’s stock at a fixed price for a defined period of time. The value of stock options reflect |

Stock options — A grant of stock options represents the right to purchase the Company’s stock at a fixed price for a defined period of time. The value of stock options reflects the difference between the value of shares of Common Stock at the time of exercise of the stock options and a predetermined exercise price. Stock options are designed to attract and retain executives by compensating them for increases in shareholder value over time. Time-based stock options are generally exercisable in one-third increments at one year, two years, and three years from the date of grant. Performance-based stock options vest at the end of the performance period provided that underlying goals are met. All stock options have a seven-year contractual life from the date of grant. As with restricted stock grants, executives who voluntarily resign or are terminated immediately forfeit all unvested stock options unless otherwise determined by the Organization & Compensation Committee.

In order to promote improvement in the Company’s financial performance, half of the restricted stock grants, executives who voluntarily resign or are terminated for cause immediately forfeit all unvested stock options unless otherwise determined by the Organization & Compensation Committee.

The 2012 LTIP consists of two performance-based grants and a service-based grant. The grants for the 2012 LTIP were made in fiscal year 2010on March 28, 2012 with the exception of the performance-based shares granted to Mr. Boley which were granted on July 23, 2012. The performance-based grants vest on or about January 31, 2015 based on meeting performance awardstargets at November 30, 2014, and will vest uponsubject to the achievement of long-term financial performance goals setapproval by the Organization & Compensation Committee. The service-based grants vest on March 28, 2015.

The performance target for the first performance-based grant is Economic Value Added (“EVA”) and consists of a grant of restricted stock. The vesting of the performance shares depends on the level of EVA target achieved, within a minimum threshold level, and ranges from 50% to 125% of the target award. No performance shares will vest if the threshold EVA target is not achieved. Participants in the EVA restricted stock grant were Mr. Seymour with 113,407 shares, Ms. Redd with 41,026 shares, and Mr. Cambria with 25,568 shares. The number of performance shares granted represents the maximum number of shares that may vest.

The performance targets for restricted stock vesting werethe second performance-based grant are (i) sales,revenue, (ii) earnings before interest, taxes, depreciation and

30

amortization, and retirement benefit expense

(“EBITDAP”), and (iii) asset utilization

with vesting at the end of the two year performance period, each with a weighting of 33.33%(“GenCorp financial targets”). The

other halfparticipant in this group of restricted stock

grants are service based vesting over three years. is Mr. Boley with 10,000 shares which represents the maximum number of shares that may vest.The vestingservice-based grant also consists of restricted stock. The participants of the service-based restricted stock optionwere Mr. Seymour with 30,242 shares, Ms. Redd with 10,940 shares, and Mr. Cambria with 6,818 shares.

Mr. Boley also received a service-based restricted stock grant of 50,000 upon commencement of his employment with the Company. These shares vest on July 23, 2015.

In anticipation of Mr. Bregard’s retirement, a retention agreement was executed in lieu of an equity grant. This retention agreement provided that Mr. Bregard be paid a lump sum payment equal to his base salary if Mr. Bregard remained with the Company through November 30, 2012. For more information on this retention agreement see the section entitledSeverance agreement, Employment Agreement and Plan Provisions on page 38.

In determining the grants madeof the 2012 LTIP, a 75% weighting was given on performance shares and a 25% weighting was put on service-based shares. This mix was given to promote the achievement of long-

36

term performance goals to add value to the Company, and to focus on returns to shareholders, and encourage retention.

Pension Plans, 401(k) Savings Plan and Benefit Restoration Plans

Pension Plans

The Company’s defined benefit pension and benefits restoration plans (“BRP”) are frozen and no longer accruing benefits. Effective February 1, 2009 and July 31, 2009, future benefit accruals for all non-collectively bargaining unit employees including the Named Executive Officers and collective bargaining unit employees respectively, were discontinued. No employees lost their previously earned pension benefits. The Named Executive Officers participate in fiscal year 2010 arethe same frozen tax-qualified pension plans as other employees with the exception of Messrs. Seymour, Boley, and Cambria who do not participate in a pension plan because their employment commenced after benefit accruals were discontinued. These plans include the Qualified Pension Plan, a tax-qualified defined benefit plan, and the 2009 Pension BRP Plan, a non-qualified defined benefit plan.

The frozen Qualified Pension Plan is a tax-qualified defined benefit plan covering substantially all collectively bargaining unit and non-collectively bargaining unit employees hired before the freeze date. In general, normal retirement age is 65, with certain plan provisions allowing for earlier retirement. Before the freeze date, pension benefits were calculated under formulas based on meetingcompensation and length of service for salaried employees and under negotiated non-wage based formulas for bargaining unit and hourly employees. Participants will receive the Economic Value Added performance target withhighest benefit calculated under any of the formulas for which they were eligible to participate through the freeze date.

Total pension benefits for the Named Executive Officers and certain other highly compensated employees were determined under a performance periodcombination of two years.

the frozen 2009 Pension BRP Plan, which is a non-qualified plan, and the frozen Qualified Pension Plan. As set forth above, the frozen Qualified Pension Plan is a qualified pension plan that provides pension benefits for employees, the amount of which is limited under Section 401(a)(17) or 415 of the Internal Revenue Code of 1986, as amended (the “Code”) (or any successor provisions). The frozen 2009 Pension BRP Plan restored the pension plan benefits which executives and their beneficiaries would otherwise lose as a result of the limitations under Section 401(a)(17) or 415 of the Code (or any successor provisions). Eligibility to participate in the frozen 2009 Pension BRP Plan was designated by the Organization & Compensation Committee.Further details regarding benefits under these plans, including the estimated value of retirement benefits for each Named Executive Officer, are found in the section entitled2012 Pension Benefitson page 45.

401(k) Savings Plan

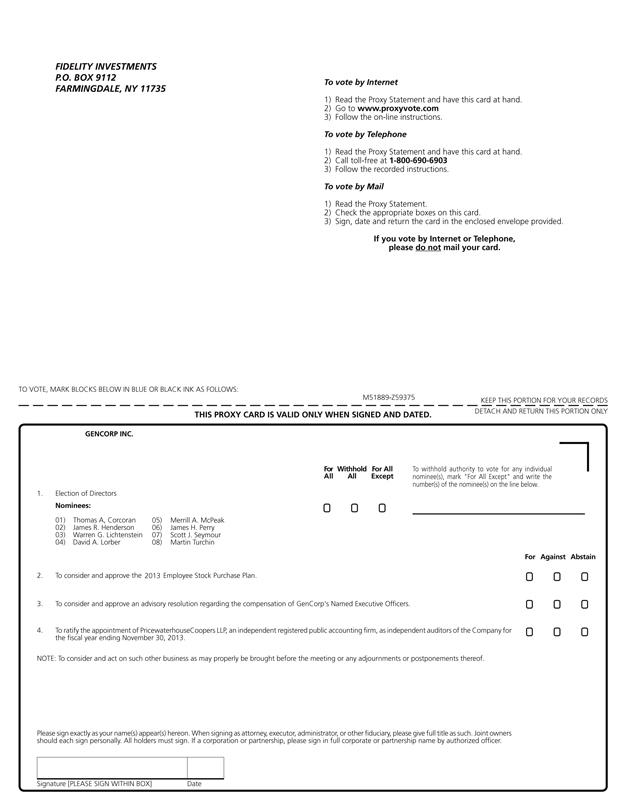

The Named Executive Officers are also eligible to participate in the GenCorp Retirement Savings Plan, a 401(k) tax-qualified defined contribution savings plan which is available to all Company employees. The Company matches 100% of the first 3% of employee contributions, and 50% of the next 3% of employee contributions for all participating employees.

2009 401(k) Benefits Restoration Plan

The Named Executive Officers participate in the related non-qualified, unfunded 2009 Benefits Restoration Plan for the GenCorp Inc. 401(k) Plan (the “2009 401(k) BRP Plan”) which enables participants to defer their compensation on a pre-tax basis. The Company matches employee contributions if the participant has reached the 402(g) limit in the 401(k) Savings Plan. Details about the 2009 401(k) BRP Plan are presented in the section entitled2012 Non-qualified Deferred Compensationon page 47.

37

Executive Stock Ownership Guidelines

In order to strengthen the alignment between the interests of shareholders and the interests of executives of the Company, the Organization & Compensation Committee approved revised share ownership guidelines that apply to the Company’s executive officers. Under these guidelines, each executive officer is expected to have equity in the Company equal in aggregate market value to a designated multiple of such officer’s annual salary (CEO — five times base salary, President — three times base salary and Vice Presidents — one timestime base salary.) In calculating the amount of equity owned by an executive, the Organization & Compensation Committee looks at the value of Company stock owned by the executive (regardless of whether it iswhich includes vested or unvested restricted stock),stock as well as unvested performance-based restricted shares at the percentage expected to vest, and the value of any vested “in the money” stock options or SARs (i.e. market value of stock in excess of the strike price for the stock option or SAR.) Newly appointed executives are expected to be in compliance with the ownership guidelines within five years of their appointments.appointments and are required to retain 50% of the net shares obtained through vesting of shares or obtained through an exercise of stock options until the executive is in compliance with, and will remain in compliance after any sale with the established guidelines. As of February 1, 2011, because of the significant drop in the Company’s stock price and the amount of time the Named Executive Officers have been in his or her position, noneDecember 31, 2012, most of the Named Executive Officers who are currently employed by the Company held equity in the Company equal in market value to these guidelines; however, all of such Named Executive Officersthose that do not yet meet the requirement are in the transition period set forth in these guidelines.guidelines and are anticipated to meet these guidelines by the end of the transition period. The Organization & Compensation Committee routinely reviews these guidelines, periodically, and considers adjustments when appropriate.

Pension Plans, 401(k) Savings Plan and Benefit Restoration Plans

Pension Plans

On November 25, 2008, the Company amended the defined benefit pension and benefits restoration plans (“BRP”) to freeze future accruals under such plans. Effective February 1, 2009 and July 31, 2009, future benefit accruals for all current employees including the Named Executive Officers and collective bargaining unit employees respectively, were discontinued. No employees lost their previously earned pension benefits.

The Named Executive Officers participate in the same tax-qualified pension plans as other employees with the exception of Mr. Seymour who does not participate in a pension plan because his employment commenced after benefit accruals were discontinued. These plans include the Qualified Pension Plan, a tax-qualified defined benefit plan, and the 2009 Pension BRP Plan, a non-qualified defined benefit plan. The purpose of the 2009 Pension BRP Plan was to restore the pension plan benefits which executives and other highly compensated management personnel and their beneficiaries would otherwise lose as a result of the limitations under Section 401(a)(17) or 415 of the Internal Revenue Code of 1986, as amended (the “Code”) or any successor provisions from a tax-qualified pension plan, upon accrualand/or payment of benefits from the Qualified Pension Plan. By restoring such benefits, the 2009 Pension BRP Plan permits the total benefits to be provided on the same basis as applicable to all other employees under the Qualified Pension Plan. There were no employee contributions required in order to participate in these defined benefit plans. Eligibility to participate in the 2009 Pension BRP Plan was designated by the Organization & Compensation Committee.

Further details regarding benefits under these plans, including the estimated value of retirement benefits for each Named Executive Officer, are found in the section entitled2010 Pension Benefitson page 38. The change in the actuarial pension value from fiscal year 2009 to fiscal year 2010 is presented in the “Change in Pension Value” column of theSummary Compensation Tableon page 34 which represents the change in present value of benefits accrued up until the freeze date.

31

| | | | | | |

| Name | | Value of Equity Ownership* | | Date of Election | | Years as an Officer |

Scott J. Seymour | | $2,763,080 | | 01/06/2010 | | 3.0 |

Kathleen E. Redd | | 1,006,535 | | 07/01/2006 | | 6.6 |

Warren M. Boley, Jr. | | 567,300 | | 08/20/2012 | | 0.4 |

Richard W. Bregard | | 432,561 | | 02/11/2006 | | 7.0 |

Christopher C. Cambria | | 283,874 | | 09/12/2011 | | 1.3 |

| * | Value is based on the stock price on December 31, 2012 of $9.15. |

401(k) Savings Plan

The Named Executive Officers are also eligible to participate in the GenCorp Retirement Savings Plan, a 401(k) tax-qualified defined contribution savings plan which is available to all Company employees. Effective January 15, 2009, the Company temporarily suspended the employer matching contributions to the GenCorp Retirement Savings Plan for all non-union eligible employees. In July 2010, the Company reinstated the employer matching contributions in which 100% of the first 3% of employee contributions, and 50% of the next 3% of employee contributions are matched for all participating employees by the Company.

2009 401(k) Benefits Restoration Plan

The Named Executive Officers participate in the related non-qualified, unfunded 2009 Benefits Restoration Plan for the GenCorp Inc. 401(k) Plan (the “2009 401(k) BRP Plan”) which enables participants to defer their compensation on a pre-tax basis. Effective January 15, 2009, the Company suspended employer contributions to the 2009 401(k) BRP Plan. In July 2010, the company reinstated the employer matching contribution if the participant has reached the 402(g) limit in the 401(k) Savings Plan. Details about the 2009 401(k) BRP Plan are presented in the section entitled2010 Non-qualified Deferred Compensationon page 39.

Severance Agreements,Agreement, Employment AgreementsAgreement and Plan Provisions

Scott J. Seymour Employment Agreement

On January 6, 2010, the Company entered into an employment agreement with Mr. Seymour to serve as the Company’s President and CEO. Pursuant to his employment agreement, Mr. Seymour will earnis entitled to an annual base salary (initially in the amount of $550,000,$550,000), and is eligible for an annual incentive pay based on a target opportunity up to 125% of his annual base salary. On January 6, 2010, Mr. Seymour received 120,000 shares of the Company’s restricted common stock and an option to purchase 100,000 shares of the Company’s common stock (the “Option”). The Option has a per share exercise price equal to the last sales price reported for the Company’s common stock on the NYSE on the date of grant. Mr. Seymour is also eligible to participate in future grants pursuant to the 2009 Incentive Plan and other Company performance incentive plans extended to the senior executives of the Company generally, at levels commensurate with his position. Mr. Seymour’s employment agreement has a five-year term, unless earlier terminated in accordance with its terms. In the event that the Company terminates Mr. Seymour’s employment for Cause or Mr. Seymour resigns other than for Good Reason (as such terms are defined in his employment agreement), the Company’s obligations will generally be limited to paying Mr. Seymour his annual base salary through the termination date. If Mr. Seymour’s employment is terminated at his or the Company’s election at any time due to his death or disability, or for reasons other than Cause or Voluntary Resignation (as defined in his employment agreement), Mr. Seymour will be entitled to receive the benefits described

38

above and severance payments and benefits equal to the following, subject to certain limitations: (i) one year of his annual base salary paid in installments; (ii) an incentive payment based upon the amount of the previous year’s incentive, prorated based on the number of months of the year that Mr. Seymour worked for the Company prior to the termination paid in a lump sum; (iii) immediate vesting of any shares of the Company’s restricted common stock or options that are scheduled to vest within one year of the date of termination of employment and (iv) incentives earned but unpaid with respect to the fiscal year ending on or preceding the date of termination pursuant to the annual cash incentive program.

Also under this employment agreement, for a termination in connection with a change in control in which Mr. Seymour’s employment is terminated by the Company without cause or by the executive for good reason within two years following a change in control, Mr. Seymour will be entitled to receive a severance payment and benefits as follows: (i) a lump sum payment equal to two times the sum of his

32

base salary plus the target incentive amount for the year in which the termination takes place; (ii) immediate full vesting of outstanding restricted shares and options; (iii) and payment of any accrued incentive through the date of termination.

ChrisRichard W. Conley Severance andBregard Retention Agreement

UnderOn February 6, 2012, the severance agreementCompany’s subsidiary, Aerojet, entered into which the Company entereda Retention Agreement with Mr. Conley,Bregard. (the “Retention Agreement”) to ensure that Mr. Bregard remained with Aerojet through at least November 30, 2012 and to encourage a severancesuccessful transition to Mr. Bregard’s retirement. The Retention Agreement provided that Mr. Bregard receive a payment will become dueequal to his annual base salary then in effect if he stayed with Aerojet through at least November 30, 2012 or his termination qualified as an Eligible Early Termination (as defined below). In the event of an Eligible Early Termination, Mr. Bregard would have been entitled to receive a change in control occurs and if the executive’s employment is terminated within three years of the change in control by: (1) the Company, for any reason other than death, disability or cause, or (2) the executive, following the occurrence of one or more of the following events: (i) failure to elect, reelect or maintain the executive in office or substantially equivalent office, (ii) a significant adverse change in the nature or scope of authority or duties or reduction in base pay, incentive opportunity or employee benefits, (iii) a change in circumstances following a change in control, including, without limitation, a change in scope of business or activities for which the executive was responsible priorlump sum payment equal to the change in control, (iv) the liquidation, dissolution, merger, consolidation, reorganization or transfer of substantially all of the business or assets of the Company, (v) the relocation of principal work location in excess of 30 miles, or (vi) any material breach of the agreement by the Company.

The severance payment due to Mr. Conley in the above scenario would be equal to base salary plus incentive multiplied by a factor of two, plus the following: (i) the continuation of health benefits and life insurance coverage for 24 months, (ii) payment of $15,000 for financial counseling, (iii) payment of the amount required to cover excise taxes imposed (including any income or payroll taxes on this amount) under Section 4999 of the Code, if any, (iv) payment of costs associated with outplacement services up to 20% of the officer’s base salary within 12 months of the executive’s termination date, and (v) payment of reasonable legal fees and expenses incurred when the officer is involved in a dispute while seeking to enforce the benefits and rights provided by the agreement. All of these items will be treated as income to the employee forW-2 purposes except for the reimbursement of legal fees incurred and outplacement services.

For purposes of computing Mr. Conley’s severance payment under the severance agreement, base salary is the highest annual salary in effect for any period prior tothat he would have received from but excluding the termination date following the change in control,through and the incentive amount is the greaterincluding November 30, 2012 and reimbursement of (1) the average of the annual incentivehealth insurance premiums payable under the Company’s annualConsolidated Omnibus Reconciliation Act of 1986. Mr. Bregard was entitled to participate in the fiscal 2012 short term cash incentive program in the event that he remained with Aerojet through November 30, 2012 or his termination qualified as an Eligible Early Termination, but was not entitled to participate in the long-term incentive or equity-based compensation program madeprograms in fiscal 2012 or to be made to Mr. Conley in regard to services rendered in any fiscal year during the three fiscal years immediately preceding the change in control, or (2) 75%thereafter. An “Eligible Early Termination” means a termination of Mr. Conley’s maximum incentive opportunity underBregard before November 30, 2012 either (i) at the Company’s annual incentive compensation planrequest or upon the initiation of Aerojet other than for the fiscal year in which the change in control occurs. No other incentive pay or bonuses are included in the computation of Mr. Conley’s termination benefits.

A change in controlCause as defined in such severancethe Retention Agreement, (ii) due to the death or disability as defined in the Retention Agreement of Mr. Bregard, or (iii) at the request or initiation of Mr. Bregard in the event that (A) he was no longer a direct report to Scott J. Seymour, or (B) an individual other than Mr. Seymour or Mr. Bregard was elected or appointed to act as President of Aerojet and, in either case, Mr. Bregard suffered a significant change or diminution in his duties and responsibilities. The terms of this agreement occurredwere met and Mr. Bregard was paid $265,364 on March 5, 2008 as a result ofDecember 13, 2012. On February 12, 2013, the ShareholderRetention Agreement and as such the agreement will expire three years from this date which is March 5, 2011.

Effective April 15, 2009, the Company entered into a retention agreement withwas amended to provide that Mr. Conley in which heBregard will receive a retention bonus equal topayment of $200,000 if he continues to be employed by the Company on March 6, 2011.

remains with Aerojet through at least May 31, 2013.Other

The GenCorp Foundation matches all employee and Director gifts to accredited, non-profit colleges, universities, secondary and elementary public or private schools located in the United States. Gifts made wereare matched dollar for dollar up to $3,000 per calendar year per donor.

33As part of an employment offer, the Company paid a hiring bonus of $25,000 to Mr. Cambria on his employment commencement date of September 12, 2011. The bonus was conditioned upon Mr. Cambria’s acceptance of the employment offer and employment with the Company for a period of one year. In the

39

event Mr. Cambria voluntarily terminated his employment with the Company or was terminated for cause within the one-year period, Mr. Cambria agreed to reimburse the Company within 30 days of termination.

Tax Deductibility under Section 162(m)

Section 162(m) of the Code imposes limits on the deductibility of certain compensation in excess of $1 million paid to the CEO and other executive officers of public companies. Management and the Organization & Compensation Committee have reviewed the regulations and feel that the current compensation program and policies are appropriate. Depending upon a variety of factors (including Company performance), it is possible for one current executive officer to surpass the $1 million dollar threshold under the executive officer compensation program. In addition, severance payments paid to certain of the former executive officers and which may be paid to one other executive officer in the event of qualified terminations under the executive severance agreements may exceed the $1 million threshold. At this time, the Organization & Compensation Committee believes that accommodating the Internal Revenue Service regulations will not produce material benefits or increases in shareholder value. However, the Organization & Compensation Committee intends to review this issue regularly and may change its position in future years.

Employee Compensation Policies Relating to Risk Management

The Organization & Compensation Committee believes none of the Company’s compensation policies and practices are reasonably likely to motivate inappropriate risk-taking behavior or have a material adverse effect on the Company. The Company believes that its compensation plans effectively balance risk and reward and are generally uniform in design and operation throughout the Company.

Limited Government Reimbursement of Compensation

As a government contractor, the Company is subject to the Federal Acquisition Regulation, which limits the reimbursement of costs by our government customers for senior executive compensation to a benchmark compensation cap established each year. The cap applies to the five most highly compensated executives per segment of the Company. For 2011, the benchmark cap published in the Federal Register was $763,029. The 2012 amount has not yet been published. Any amounts over the cap are considered unallowable and, therefore, not billed to the government.

40

SUMMARY COMPENSATION TABLE

The following table sets forth information regarding compensation for each of the Named Executive Officers for fiscal years 2010, 20092012, 2011 and 2008.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Non-Equity

| | | Change in

| | | | | | |

| | | | | | | | | | | | | Stock

| | | Options/SARs

| | | Incentive Plan

| | | Pension

| | | All Other

| | | |

| Name and Principal Position | | | Year | | | Salary(1) | | | Bonus | | | Awards(2) | | | Awards(2) | | | Compensation(3) | | | Value(4) | | | Compensation(5) | | | Total |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Scott J. Seymour(6)

President and CEO; President of

Aerojet-General Corporation | | | | 2010 | | | | $ | 495,529 | | | | $ | — | | | | $ | 856,800 | | | | $ | 771,513 | | | | $ | 845,625 | | | | $ | — | | | | $ | 53,087 | | | | $ | 3,022,554 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kathleen E. Redd | | | | 2010 | | | | | 324,969 | | | | | — | | | | | — | | | | | 121,799 | | | | | 206,640 | | | | | 32,662 | | | | | 375 | | | | | 686,445 | |

| Vice President, CFO and Secretary(7) | | | | 2009 | | | | | 294,308 | | | | | 70,000 | | | | | 43,133 | | | | | 34,286 | | | | | 230,000 | | | | | 73,100 | | | | | 2,600 | | | | | 752,427 | |

| | | | | 2008 | | | | | 228,533 | | | | | — | | | | | — | | | | | 25,490 | | | | | 133,000 | | | | | 14,531 | | | | | 10,332 | | | | | 411,886 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard W. Bregard

Deputy to the President | | | | 2010 | | | | | 225,890 | | | | | 4,660 | | | | | 82,858 | | | | | — | | | | | 146,254 | | | | | 8,490 | | | | | — | | | | | 468,152 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chris W. Conley(8) | | | | 2010 | | | | | 222,119 | | | | | — | | | | | 29,866 | | | | | 17,469 | | | | | 136,064 | | | | | 99,719 | | | | | 1,290 | | | | | 506,527 | |

| Vice President, Environmental, | | | | 2009 | | | | | 212,328 | | | | | — | | | | | 12,033 | | | | | 7,347 | | | | | 148,000 | | | | | 240,190 | | | | | 1,840 | | | | | 621,738 | |

| Health & Safety | | | | 2008 | | | | | 205,361 | | | | | — | | | | | — | | | | | — | | | | | 106,000 | | | | | 10,645 | | | | | 8,162 | | | | | 330,168 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Former Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| J. Scott Neish | | | | 2010 | | | | $ | 36,355 | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | (9) | | | $ | 1,330,632 | | | | $ | 1,366,987 | |

| Interim President and CEO and Vice | | | | 2009 | | | | | 350,088 | | | | | — | | | | | — | | | | | — | | | | | 536,000 | | | | | 174,386 | | | | | 19,704 | | | | | 1,080,178 | |

| President; and President, Aerojet-General Corporation | | | | 2008 | | | | | 340,137 | | | | | 350,000 | (10) | | | | — | | | | | — | | | | | 357,000 | | | | | 112,505 | | | | | 29,603 | | | | | 1,189,245 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | | Salary(1) | | | Bonus | | | Stock Awards(2) | | | Options/ SARs Awards(2) | | | Non-Equity Incentive Plan Compensation(3) | | | All Other Compensation(4) | | | Total(5) | |

Scott J. Seymour(6) | | | 2012 | | | $ | 587,885 | | | $ | — | | | $ | 825,002 | (7) | | $ | — | | | $ | 1,117,500 | | | $ | 16,334 | | | $ | 2,546,721 | |

President and CEO | |

| 2011

2010 |

| |

| 550,000

495,529 |

| |

| —

— |

| |

| 278,642

856,800 |

| |

| 116,149

771,513 |

| |

| 935,000

845,625 |

| |

| 87,046

53,087 |

| |

| 1,966,837

3,022,554 |

|

Kathleen E. Redd | | | 2012 | | | | 366,819 | | | | — | | | | 298,450 | (8) | | | — | | | | 262,081 | | | | 11,250 | | | | 938,600 | |

Vice President, CFO and Assistant Secretary | |

| 2011

2010 |

| |

| 347,003

324,969 |

| |

| —

— |

| |

| 95,328

— |

| |

| 39,735

121,799 |

| |

| 241,000

206,640 |

| |

| 12,100

375 |

| |

| 735,166

653,783 |

|

Warren M. Boley, Jr.(9) | | | 2012 | | | | 127,885 | | | | — | | | | 469,960 | (10) | | | — | | | | 99,750 | | | | 12,075 | | | | 709,670 | |

President, Aerojet | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard W. Bregard | | | 2012 | | | | 263,177 | | | | 265,364 | (11) | | | — | | | | — | | | | 189,072 | | | | 11,143 | | | | 728,756 | |

Deputy to the President, Aerojet | |

| 2011

2010 |

| |

| 250,712

225,890 |

| |

| 35,000

4,660 |

| |

| 109,749

82,858 |

| |

| —

— |

| |

| 174,000

146,254 |

| |

| 10,676

— |

| |

| 580,137

459,662 |

|

Christopher C. Cambria(12) | | | 2012 | | | | 316,558 | | | | — | | | | 186,002 | (13) | | | — | | | | 220,550 | | | | 51,755 | | | | 774,865 | |

Vice President, General Counsel and Secretary | | | 2011 | | | | 65,577 | | | | 25,000 | (14) | | | — | | | | 69,766 | | | | 52,000 | | | | 10,132 | | | | 222,475 | |

| | |

| (1) | | The amount reported in this column for each Named Executive Officer reflects the dollar amount of base salary earned in each listed fiscal year. |

| |

| (2) | | The amounts reported in these columns for each Named Executive Officer represents the aggregate grant date fair value of awards granted in each of the three years presented. The grant date fair value of stock awards is equal to the closing price of our stock on the date of grant times the number of shares awarded. The grant date fair value of stock options and SARs awards was estimated using the Black-Scholes Model. A discussion of the assumptions used in calculating these values may be found in Note 9(c) in the audited financial statements in the Company’s Annual Report onForm 10-K for fiscal year 2010. The values reported for 2008 and 2009 differ from the values previously reported in our 2009 and 2010 Proxy Statements which reported the amount of compensation costs recognized for financial reporting purposes according to GAAP without the impact of estimated forfeitures.2012. A description of these awards can be found under the section entitledLong-Term Incentives (Equity-Based Compensation)on page 29.35. |

| |

| (3) | | The amount reported in this column for each Named Executive Officer reflects annual cash incentive compensation, which is based on performance in each listed fiscal year. This annual incentive compensation is discussed further under the section entitledShort-Term CompensationAnnual Cash Incentive Programon page 27.31. |

34

| | |

| (4) | | The amount reported in this column for each Named Executive Officer reflects the aggregate increase in the actuarial present value of their accumulated benefits under all pension plans. The following table shows the measurement dates and discount rates used for each year presented in the table: |

| | | | | | | | | | | | | | |

| | | | | | | | Discount Rate for Qualified

| | | | Discount Rate for

|

| Year | | | | Measurement Period | | | Pension Plan | | | | Pension BRP Plan |

| | 2010 | | | | December 1, 2009 to November 30, 2010 | | | | 5.21% | | | | 5.34% |

| | | | | | | | | | | | | | |

| | 2009 | | | | September 1, 2008 to November 30, 2009 | | | | 5.65% | | | | 5.60% |

| | | | | | | | | | | | | | |

| | 2008 | | | | September 1, 2007 to August 31, 2008 | | | | 7.10% | | | | 7.05% |

| | | | | | | | | | | | | | |

| | |

| | The increase in pension value for current Executive Officers in 2010 is due to changes in actuarial assumptions which is primarily the decrease in the discount rate used to measure the present value of benefits accrued up until the freeze date. There was no change to the pension accrual related to service, as each of the Named Executive Officers’ pension benefits were frozen on February 1, 2009. |

|

| | These amounts were determined using the actuarial assumptions consistent with those used in the Company’s financial statements with the exception of assumed retirement age and the absence of pre-retirement mortality and termination assumptions. A discussion of the assumptions used for financial reporting purposes may be found in Note 6 in the audited financial statements in the Company’s Annual Report onForm 10-K for fiscal year 2010. Information regarding these pension plans is set forth in further detail under the section entitled2010 Pension Benefitson page 38. |

|

(5) | | The amounts reported in this column for each Named Executive Officer include the following for fiscal year 2010:2012: |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Severance | | | Company Matching Contribution to 401(k) Plan | | | Company Matching Contribution to Benefits Restoration Plan- Savings Plan | | | Matching Gift by the GenCorp Foundation | | | Perquisites And Other Personal Benefits(A) | | | Total | |

Scott J. Seymour | | $ | — | | | $ | 11,250 | | | $ | 2,084 | | | $ | 3,000 | | | $ | — | | | $ | 16,334 | |

Kathleen E. Redd | | | — | | | | 11,250 | | | | — | | | | — | | | | — | | | | 11,250 | |

Warren M. Boley, Jr. | | | — | | | | 2,423 | | | | — | | | | — | | | | 9,652 | | | | 12,075 | |

Richard W. Bregard | | | — | | | | 11,143 | | | | — | | | | — | | | | — | | | | 11,143 | |

Christopher C. Cambria | | | — | | | | 11,117 | | | | — | | | | — | | | | 40,638 | | | | 51,755 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Company

| | | | | | | | | |

| | | | | | | | | | Matching

| | | | | | | | | |

| | | | | | | | | | Contribution to

| | | | | | | | | |

| | | | | | | Company

| | | Benefits

| | | | | | Perquisites

| | | |

| | | | | | | Matching

| | | Restoration

| | | Matching Gift

| | | And Other

| | | |

| | | | | | | Contribution to

| | | Plan-

| | | by the GenCorp

| | | Personal

| | | |

| Name | | | Severance | | | 401(k) Plan | | | Savings Plan | | | Foundation | | | Benefits(A) | | | Total |

Executive Officers as of November 30, 2010 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Scott J. Seymour | | | $ | — | | | | $ | — | | | | $ | 9,519 | | | | $ | 3,000 | | | | $ | 40,568 | (B) | | | $ | 53,087 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kathleen E. Redd | | | | — | | | | | — | | | | | — | | | | | 375 | | | | | — | | | | | 375 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Richard W. Bregard | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chris W. Conley | | | | — | | | | | — | | | | | — | | | | | 1,290 | | | | | — | | | | | 1,290 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Former Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| J. Scott Neish | | | $ | 1,330,632 | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | 1,330,632 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (A) | | This column includes items that are accrued or paid by the Company and will be included as compensationor reimbursed to the Named Executive Officer in the year the amounts are paid. |

|

(B) | | This amount represents $25,568employee for relocation costsexpenses. |

| (5) | The total compensation shown for Ms. Redd and $15,000Mr. Bregard in fiscal years 2010 and 2011 does not reflect the Change in Pension Value as previously disclosed because the Company’s defined benefit pension and BRP have been frozen and not accruing benefits for legal fees incurred that were reimbursed to Mr. Seymour.three years. Changes in pension value previously reported are as follows: |

| | | | | | | | |

| Name | | Year | | | Change in Pension Value | |

Kathleen E. Redd | | | 2011 | | | $ | 26,199 | |

| | | | 2010 | | | | 32,662 | |

Richard W. Bregard | | | 2011 | | | | 311 | |

| | | | 2010 | | | | 8,490 | |

Because the plans are frozen, these amounts represent changes in actuarial assumptions, primarily the decrease in the discount rate and a change in mortality assumption used to measure the present value of benefits accrued up until the freeze date, which

41

is the same for all plan participants. There is no further accrual of pension benefits for service. Information regarding these pension plans is set forth in further detail under the section entitled 2012 Pension Benefits on page 45.

| | |

| (6) | | Mr. Seymour started his employment with the Company on January 6, 2010. |

|

(7) | | Ms. Redd was appointed CFO2010 as President and SecretaryCEO of the Company effective January 21, 2009, and February 11, 2009, respectively. The bonus amount paidPresident, Aerojet. On August 20, 2012, Mr. Seymour relinquished the President, Aerojet role to Ms. Redd in 2009 represents a discretionary bonus for 2009 performance as approved by the Organization & Compensation Committee.Mr. Boley. |

| (7) | Mr. Seymour’s stock awards compensation consists of $206,251 for a service-based restricted stock grant and $618,751 for a performance-based restricted stock grant that vests based on financial performance for fiscal year 2014. The grant date fair value of the performance-based restricted stock grant at the maximum vesting of 125% would be $773,436. |

| (8) | Ms. Redd’s stock awards compensation consists of $74,611 for a service-based restricted stock grant and $223,839 for a performance-based restricted stock grant that vests based on financial performance for fiscal year 2014. The grant date fair value of the performance-based restricted stock grant at the maximum vesting of 125% would be $279,797. |

| (9) | Mr. Boley started his employment with the Company on July 23, 2012, and assumed full responsibility as President, Aerojet on August 20, 2012. |

| (10) | Mr. Boley’s stock awards compensation consists of $379,000 for a service-based restricted stock grant and $30,320 for a performance-based restricted stock grant that vests based on financial performance for fiscal year 2013. The grant date fair value of this performance-based restricted stock grant at the maximum vesting of 125% would be $75,800. Also included is $60,640 for a performance-based restricted stock grant that vests based on financial performance for fiscal year 2014. The grant date fair value of this performance-based restricted stock grant at the maximum vesting of 125% would be $75,800. |

| (11) | Effective April 15, 2009,February 6, 2012, the Company entered into a retention agreement with Mr. Conley inBregard pursuant to which he willwas to receive a retention bonuspayment equal to $200,000his annual base salary in effect at November 30, 2012 if he continues to bewas employed by the Company through that date. The terms of the agreement were met and the Company paid Mr. Bregard $265,364 on March 6,December 13, 2012. On February 12, 2013, this agreement was amended to provide that Mr. Bregard will receive a payment of $200,000 if he remains with Aerojet through at least May 31, 2013. For more details on this agreement see page 48. |

| (12) | Mr. Cambria started his employment with the Company on September 12, 2011. |

|

(9)(13) | | Mr. Cambria’s stock awards compensation consists of $46,499 for a service-based restricted stock grant and $139,503 for a performance-based restricted stock grant that vests based on financial performance for fiscal year 2014. The presentgrant date fair value of the performance-based restricted stock grant at the maximum vesting of 125% would be $174,374. |

| (14) | Mr. Neish’s Pension value decreased by $9,849 in fiscal year 2010 due to the assumptions being revised to reflect actual elections sinceCambria received a $25,000 sign-on bonus upon commencement of his benefit payout has started versus estimated elections which were used for his 2009 valuation. |

|

(10) | | This amount paid to Mr. Neish is in accordanceemployment with the letter agreement byCompany. A further description of this bonus can be found on page 39 under the section entitledOtherof the Compensation Discussion and between the Company and Mr. Neish dated March 5, 2008, as part of his appointment to the position of Interim President and CEO and represents a one-time bonus for serving in this capacity.Analysis. |

35

42

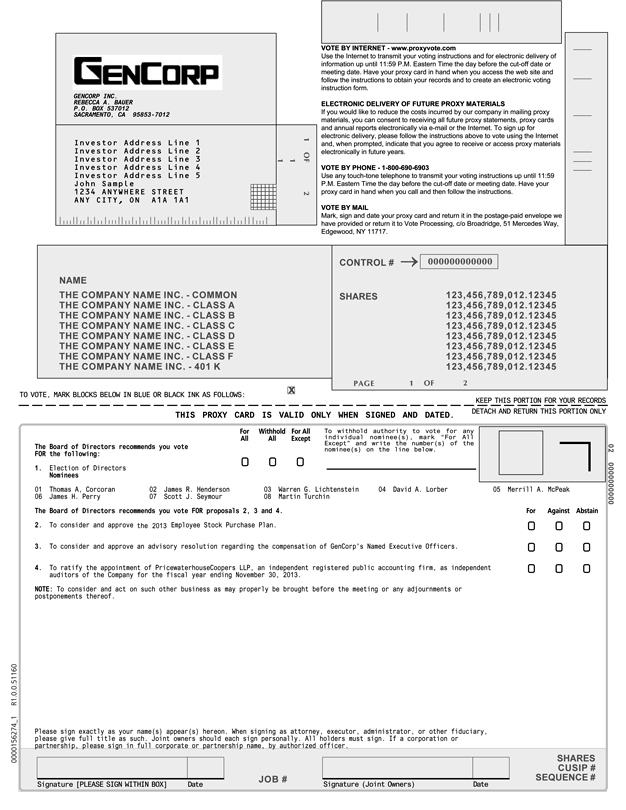

20102012 GRANTS OF PLAN-BASED AWARDS

The following table provides information for each of the Named Executive Officers for fiscal year 20102012 annual and long-term incentive award opportunities, including the range of possible payments under non-equity incentive plans.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Other

| | | | All

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Stock

| | | | Other

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Awards:

| | | | Option

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Number of

| | | | Awards:

| | | | Exercise

| | | | Grant Date

| |

| | | | | | | | Estimated Possible Payouts Under

| | | | Estimated Future Payouts

| | | | Shares of

| | | | Number of

| | | | or Base

| | | | Fair Value

| |

| | | | | | | | Non-Equity Incentive Plan

| | | | Under Equity Incentive Plan

| | | | Stock

| | | | Securities

| | | | Price of

| | | | of Stock and

| |

| | | | Grant

| | | | Awards ($)(1) | | | | Awards(#) | | | | or

| | | | Underlying

| | | | Options/SARs

| | | | Option/SARs

| |

| Name | | | Date | | | | Threshold(2) | | | | Target | | | | Maximum | | | | Threshold | | | | Target | | | | Maximum | | | | Units(#) | | | | Options(#) | | | | ($/Sh) | | | | Awards | |

Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Scott J. Seymour | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Incentive Award | | | | | | | | $ | — | | | | $ | 687,500 | | | | $ | 1,203,125 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | 01-06-10 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 120,000 | | | | | | | | | | | | | | $ | 856,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | 01-06-10 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 100,000 | | | | $ | 7.14 | | | | | 415,490 | (3) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | 119,732 | | | | | 239,464 | | | | | 299,330 | | | | | | | | | | | | | | | 4.91 | | | | | 356,023 | (4) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Kathleen. E. Redd | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Incentive Award | | | | | | | | | — | | | | | 168,000 | | | | | 294,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | 40,962 | | | | | 81,923 | | | | | 102,404 | | | | | | | | | | | | | | | 4.91 | | | | | 121,799 | (4) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard W. Bregard | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Incentive Award | | | | | | | | | — | | | | | 117,004 | | | | | 204,756 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | 4,728 | | | | | 9,455 | | | | | 11,819 | | | | | | | | | | | | | | | | | | | | 36,434 | (5) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 9,455 | | | | | | | | | | | | | | | 46,424 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chris W. Conley | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Incentive Awards | | | | | | | | | — | | | | | 112,450 | | | | | 196,788 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | 1,704 | | | | | 3,408 | | | | | 4,260 | | | | | | | | | | | | | | | | | | | | 13,132 | (5) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,408 | | | | | | | | | | | | | | | 16,733 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | 11-30-10 | | | | | | | | | | | | | | | | | | | | 5,875 | | | | | 11,750 | | | | | 14,688 | | | | | | | | | | | | | | | 4.91 | | | | | 17,469 | (4) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Former Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

J. Scott Neish | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Grant

Date | | | Estimated Possible Payouts Under Non-Equity Incentive Plan

Awards ($)(1) | | | Estimated Future Payouts

Under Equity Incentive Plan

Awards(#) | | | Other

Stock

Awards:

Number

of Shares

of Stock

or

Units(#) | | | All Other

Option

Awards:

Number of

Securities

Underlying

Options(#) | | Exercise

or Base

Price of

Options/SARs

($/Sh) | | Grant Date

Fair Value of

Stock and

Option/SARs

Awards($) | |

| | | Threshold (2) | | | Target | | | Maximum | | | Threshold | | | Target | | | Maximum | | | | | |

Scott J. Seymour | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Incentive Award | | | | | | $ | — | | | $ | 750,000 | | | $ | 1,387,500 | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | 03/28/12 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 30,242 | | | | | | | $ | 206,251 | |

Restricted Stock | | | 03/28/12 | | | | | | | | | | | | | | | | 45,363 | | | | 90,726 | | | | 113,407 | | | | | | | | | | | | 618,751 | (3) |

Kathleen. E. Redd | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Incentive Award | | | | | | | — | | | | 185,216 | | | | 342,650 | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | 03/28/12 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 10,940 | | | | | | | | 74,611 | |

Restricted Stock | | | 03/28/12 | | | | | | | | | | | | | | | | 16,411 | | | | 32,821 | | | | 41,026 | | | | | | | | | | | | 223,839 | (3) |

Warren M. Boley, Jr. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Incentive Award | | | | | | | — | | | | 70,000 | | | | 129,500 | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | 07/23/12 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 50,000 | | | | | | | | 379,000 | |

Restricted Stock | | | 07/23/12 | | | | | | | | | | | | | | | | 4,000 | | | | 8,000 | | | | 10,000 | | | | | | | | | | | | 30,320 | (4) |

Restricted Stock | | | 07/23/12 | | | | | | | | | | | | | | | | 4,000 | | | | 8,000 | | | | 10,000 | | | | | | | | | | | | 60,640 | (3) |

Richard W. Bregard | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Incentive Award | | | | | | | — | | | | 132,682 | | | | 245,462 | | | | | | | | | | | | | | | | | | | | | | | | | |

Christopher C. Cambria | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Incentive Award | | | | | | | — | | | | 158,100 | | | | 292,485 | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | 03/28/12 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 6,818 | | | | | | | | 46,499 | |

Restricted Stock | | | 03/28/12 | | | | | | | | | | | | | | | | 10,228 | | | | 20,455 | | | | 25,568 | | | | | | | | | | | | 139,503 | (3) |

| | |

| (1) | | Reflects the possible payout amounts of non-equity incentive plan awards that could have been earned in fiscal year 2010.2012. See theSummary Compensation Tableon page 3441 for the amounts actually earned in fiscal year 2012 and paid out in the first quarter of fiscal year 2011.2013. |

|

| (2) | | If no targets are not met, the annual incentive award will not be earned. |

|

| (3) | | The fair value of these stock options was estimated using a Black-Scholes Model with the following weighted average assumptions at the date of grant: Expected life — seven years; Volatility — 54.5%; Risk-free interest rate — 3.28%; Dividend yield — 0.00%. |

|

(4) | | As of November 30, 2010, the Company expects 50%Vesting of this performance-based restricted stock grant is based on financial performance grant to vest.for fiscal year 2014. The grant date fair value at 100%the maximum of 125% vesting would be $712,046$773,436 for Mr. Seymour, $243,598$279,839 for Ms. Redd, and $34,939$75,800 for Mr. Conley based on a Black-Scholes value of $2.9735. The Black-Scholes Model used the following weighted average assumptions at the date of grant: Expected life — seven years; Volatility — 55.7%; Risk-free interest rate — 2.21%; Dividend yield — 0.00%.Boley, and $174,374 for Mr. Cambria. |

|

(5)(4) | | As of November 30, 2010, the Company expects 78.48%Vesting of this performanceperformance-based restricted stock grant to vest.is based on financial performance for fiscal year 2013. The grant date fair value at 100%the maximum of 125% vesting would be $46,424 for Mr. Bregard, and $16,733 for Mr. Conley.$75,800. |

36

43

OUTSTANDING EQUITY AWARDS AT 20102012 FISCAL YEAR END

The following table provides information for each of the Named Executive Officers regarding outstanding stock options, SARs, and stock awards held by the officers as of November 30, 2012.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Option/SARs Awards | | | Stock Awards | |

| | Number of Securities Underlying Unexercised Options/SARs (#) Exercisable | | | Number of Securities Underlying Unexercised Options/SARs (#) Unexercisable | | | Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Option/SARs (#) | | | Option/ SARs Exercise Price ($) | | | Option/ SARs Expiration Year | | | Service-Based Equity Awards | | | Equity Incentive Plan Awards | |

| | | | | | | Number of

Shares or

Units of

Stock That

Have Not

Vested (#) | | | Market Value

of Shares or

Units of

Stock That

Have Not

Vested ($)(1) | | | Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(1) | |

Scott J. Seymour | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | 30,242 | (2) | | $ | 278,226 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 90,726 | (4) | | $ | 834,679 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 92,726 | (5) | | | 853,079 | |

| | | | | | | | | | | | | | | | | | | | | | | | 40,000 | (3) | | | 368,000 | | | | | | | | | |

Stock Options | | | — | | | | — | | | | 65,621 | (5) | | $ | 6.01 | | | | 2018 | | | | | | | | | | | | | | | | | |

| | | | — | | | | — | | | | 239,464 | (6) | | | 4.91 | | | | 2017 | | | | | | | | | | | | | | | | | |

| | | | 66,667 | | | | 33,333 | (3) | | | — | | | | 7.14 | | | | 2017 | | | | | | | | | | | | | | | | | |

Kathleen E. Redd | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | 10,940 | (2) | | | 100,648 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 32,821 | (4) | | | 301,953 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 31,723 | (5) | | | 291,852 | |

SARs | | | 20,000 | | | | — | | | | — | | | | 4.25 | | | | 2018 | | | | | | | | | | | | | | | | | |

| | | | 1,500 | | | | — | | | | — | | | | 13.75 | | | | 2017 | | | | | | | | | | | | | | | | | |

| | | | 2,560 | | | | — | | | | — | | | | 13.19 | | | | 2016 | | | | | | | | | | | | | | | | | |

| | | | 2,500 | | | | — | | | | — | | | | 18.71 | | | | 2015 | | | | | | | | | | | | | | | | | |

Stock Options | | | 1,750 | | | | | | | | | | | | 6.00 | | | | 2019 | | | | | | | | | | | | | | | | | |

| | | | 35,000 | | | | — | | | | — | | | | 4.54 | | | | 2019 | | | | | | | | | | | | | | | | | |

| | | | — | | | | — | | | | 22,449 | (5) | | | 6.01 | | | | 2018 | | | | | | | | | | | | | | | | | |

| | | | — | | | | — | | | | 81,923 | (6) | | | 4.91 | | | | 2017 | | | | | | | | | | | | | | | | | |

| | | | 2,666 | | | | — | | | | — | | | | 9.29 | | | | 2013 | | | | | | | | | | | | | | | | | |

Warren M. Boley, Jr. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | 50,000 | (7) | | | 460,000 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,000 | (4) | | | 73,600 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,000 | (5) | | | 73,600 | |

Richard W. Bregard | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | 12,174 | (8) | | | 112,001 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12,174 | (5) | | | 112,001 | |

| | | | | | | | | | | | | | | | | | | | | | | | 9,455 | (10) | | | 86,986 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 9,455 | (6) | | | 86,986 | |

SARs | | | 1,500 | | | | — | | | | — | | | | 13.75 | | | | 2017 | | | | | | | | | | | | | | | | | |

| | | | 4,256 | | | | — | | | | — | | | | 13.19 | | | | 2016 | | | | | | | | | | | | | | | | | |

Stock Options | | | 10,000 | | | | — | | | | — | | | | 4.54 | | | | 2019 | | | | | | | | | | | | | | | | | |

| | | | 500 | | | | — | | | | — | | | | 6.00 | | | | 2019 | | | | | | | | | | | | | | | | | |

Christopher C. Cambria | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | 6,818 | (2) | | | 62,726 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 20,455 | (4) | | | 188,186 | |

SARs | | | 6,667 | | | | 13,333 | (9) | | | — | | | | 4.00 | | | | 2018 | | | | | | | | | | | | | | | | | |

| (1) | The market value was calculated by multiplying the number of shares by the closing market price of the Company’s Common Stock of $9.20 on November 30, 2012. |

44

| (2) | The vesting date for these service-based restricted stock awards is March 28, 2015. |

| (3) | Mr. Seymour’s unvested time-based stock options and restricted stock have been vesting in one-third increments on January 6th of each year which became fully vested on January 6, 2013. |

| (4) | The vesting date for these performance-based restricted stock awards is on or about January 31, 2015, subject to approval by the Organization & Compensation Committee. These awards will only vest if performance targets are met through November 30, 2014. |

| (5) | The vesting date for these performance-based stock option and restricted stock awards is on or about January 31, 2014, subject to approval by the Organization & Compensation Committee. These awards will only vest if performance targets are met through November 30, 2013. |

| (6) | The vesting date for these performance-based stock option and restricted stock awards was February 6, 2013. Performance targets were met through November 30, 2012 resulting in stock options vesting at 78.80% and restricted stock vesting at 65.87%. As a result Mr. Seymour had 188,697 stock options vest, Ms. Redd had 64,555 stock options vest, and Mr. Bregard had 6,228 stock awards vest. |

| (7) | Mr. Boley’s unvested service-based restricted stock vests on July 23, 2015. |

| (8) | The vesting date for these service-based restricted stock awards is March 30, 2014. |

| (9) | Mr. Cambria’s unvested SARs vest in one-third increments on September 12th of each year becoming fully vested in 2014. |

| (10) | The vesting date for this service-based restricted stock award is November 30, 2013. |

2012 OPTION/SAR EXERCISES AND STOCK VESTED

The following table provides information for each of the Named Executive Officers regarding stock options,option and SARs exercises and outstanding stock awards held by the officers as of November 30, 2010.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Option/SARs Awards | | | Stock Awards |

| | | | | | | | | | | | | | | | | | | Service-Based Equity

| | | Equity Incentive

|

| | | | | | | | | | | | | | | | | | | Awards | | | Plan Awards |

| | | | | | | | | | Equity

| | | | | | | | | | | | |

| | | | | | | | | | Incentive

| | | | | | | | | | | | | | | Number of

| | | Market or

|

| | | | | | | | | | Plan Awards:

| | | | | | | | | | | | Market Value

| | | Unearned

| | | Payout Value

|

| | | | | | | Number of

| | | Number of

| | | | | | | | | Number of

| | | of Shares

| | | Shares, Units

| | | of Unearned

|

| | | | Number of

| | | Securities

| | | Securities

| | | | | | | | | Shares or

| | | or Units of

| | | or Other

| | | Shares, Units

|

| | | | Securities

| | | Underlying

| | | Underlying

| | | Option/

| | | | | | Units of

| | | Stock

| | | Rights That

| | | or Other

|

| | | | Underlying

| | | Unexercised

| | | Unexercised

| | | SARs

| | | Option/

| | | Stock That

| | | That

| | | Have

| | | Rights That

|

| | | | Unexercised

| | | Options/SARs

| | | Unearned

| | | Exercise

| | | SARs

| | | Have Not

| | | Have Not

| | | Not

| | | Have Not

|

| | | | Options/SARs (#)

| | | (#)

| | | Option/SARs

| | | Price

| | | Expiration

| | | Vested

| | | Vested

| | | Vested

| | | Vested

|

| Name | | | Exercisable | | | Unexercisable | | | (#) | | | ($) | | | Year | | | (#) | | | ($)(1) | | | (#) | | | ($)(1) |

Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Scott J. Seymour | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 120,000(2 | ) | | | $ | 589,200 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | — | | | | | — | | | | | 239,464 | (3) | | | $ | 4.91 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | — | | | | | 100,000(2 | ) | | | | | | | | | 7.14 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Kathleen E. Redd | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 30,000(4 | ) | | | $ | 147,300 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SARs | | | | 20,000 | | | | | — | | | | | — | | | | | 4.25 | | | | | 2018 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 1,500 | | | | | — | | | | | — | | | | | 13.75 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2,560 | | | | | — | | | | | — | | | | | 13.19 | | | | | 2016 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2,500 | | | | | — | | | | | — | | | | | 18.71 | | | | | 2015 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | — | | | | | — | | | | | 81,923 | (3) | | | | 4.91 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | — | | | | | — | | | | | 35,000 | (5) | | | | 4.54 | | | | | 2019 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2,666 | | | | | — | | | | | — | | | | | 9.29 | | | | | 2013 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 1,333 | | | | | — | | | | | — | | | | | 10.85 | | | | | 2012 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard W. Bregard | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 10,000(4 | ) | | | | 49,100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 9,455(6 | ) | | | | 46,424 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 9,455(7 | ) | | | | 46,424 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SARs | | | | 1,500 | | | | | — | | | | | — | | | | | 13.75 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 4,256 | | | | | — | | | | | — | | | | | 13.19 | | | | | 2016 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | — | | | | | — | | | | | 10,000 | (5) | | | | 4.54 | | | | | 2019 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chris W. Conley | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 7,500(4 | ) | | | | 36,825 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,408(6 | ) | | | | 16,733 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,408(7 | ) | | | | 16,733 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SARs | | | | 12,000 | | | | | — | | | | | — | | | | | 13.75 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 13,800 | | | | | | | | | | | | | | | 19.34 | | | | | 2016 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2,000 | | | | | | | | | | | | | | | 18.51 | | | | | 2015 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | — | | | | | — | | | | | 11,750 | (3) | | | | 4.91 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | — | | | | | — | | | | | 7,500 | (5) | | | | 4.54 | | | | | 2019 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 5,000 | | | | | — | | | | | — | | | | | 7.73 | | | | | 2013 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 5,000 | | | | | — | | | | | — | | | | | 15.43 | | | | | 2012 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 10,000 | (8) | | | | | | | | | | | | | | 10.44 | | | | | 2011 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Former Executive Officers as of November 30, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Scott J. Neish(9) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Stock | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | $ | — | | | | | — | | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SARs | | | | 30,000 | | | | | — | | | | | — | | | | $ | 13.75 | | | | | 2017 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 21,500 | | | | | — | | | | | — | | | | | 19.34 | | | | | 2016 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 5,000 | | | | | — | | | | | — | | | | | 18.55 | | | | | 2015 | | | | | | | | | | | | | | | | | | | | | |

| | | | | 3,500 | | | | | — | | | | | — | | | | | 18.71 | | | | | 2015 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | | | 2,200 | | | | | — | | | | | — | | | | | 9.29 | | | | | 2013 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Name | | Option/SARs Awards | | | Stock Awards | |

| | Number of

Shares

Acquired on

Exercise (#) | | | Value

Realized on

Exercise ($)(1) | | | Number of

Shares

Acquired on

Vesting (#)(2) | | | Value

Realized on

Vesting

($)(3) | |

Scott J. Seymour | | | — | | | $ | — | | | | 40,000 | | | $ | 216,800 | |

Kathleen E. Redd | | | — | | | | — | | | | 31,925 | | | | 191,550 | |

Warren M. Boley, Jr. | | | — | | | | — | | | | — | | | | — | |

Richard W. Bregard | | | — | | | | — | | | | 10,621 | | | | 63,726 | |

Christopher C. Cambria | | | — | | | | — | | | | — | | | | — | |

| | |

| (1) | The value realized on vesting represents the difference between the closing market price of the Company’s Common Stock on the exercise date and the exercise price multiplied by the number of shares underlying each option exercised. |

| (2) | The marketamounts reported in this column reflect restricted stock awards that vested during fiscal year 2012. |

| (3) | The value wasrealized on vesting is calculated by multiplying the number of unvested shares vested by the closing market price of the Company’s Common Stock of $4.91 on November 30, 2010. |

|

(2) | | Mr. Seymour’s unvested time-based stock options and restricted stock vests in one-third increments on January 6th of each year becoming fully vested in 2013. On January 6, 2011, Mr. Seymour vested in 40,000 restricted shares and 33,334 stock options. |

|